New legislation in the works

In August 2022, Minnesota passed legislation to begin the process of legalizing sports betting. Since then, two bills have come to the forefront: HF2000, proposed by Democrats, and SF 3803 (Minnesota Sports Betting Act 2.0), proposed by Republicans.

Back in 1992, the Professional and Amateur Sports Protection Act (PASPA) was passed and outlawed sports betting nationally with the exception of Oregon, Delaware and Montana. These states already had sports betting explicitly allowed in their laws, which other states did not have. Overturned by the Supreme Court in 2018, the U.S. legislation left the status of sports betting to state governments. Since then, 38 states have legalized sports betting, and 11, including Minnesota, are undergoing the process of legalization.

Currently, the biggest obstacle to legalizing sports betting in Minnesota is reaching a compromise between Republicans and Democrats, specifically regarding how much control racetracks and Native American tribes should have over sports betting.

The Republican proposal, known as the Sports Betting Act 2.0, combines multiple sports betting bills. Proposed by Senator Jeremy Miller (R-Winona), this act aims to legalize retail and mobile sports betting at racetracks, sports facilities and online platforms. The bill will also enforce a 15% tax rate on sports betting revenue, which will be used to provide tax relief to local charities and, ironically, to fund gambling addiction resources.

Another component of the bill is revisions to restrictions on e-pull tabs from the 2023 Sports Betting Act. E-pull tabs, a digital version of traditional paper pull tabs, were legalized in 2012 as legislation has deemed them unable to mimic traditional pull tabs. Currently, 6% of the price of e-pull tabs are taxed, and its tax revenue has successfully filled the state tax coffers and paid off the debt from building the U.S. Bank Stadium. The new Republican bill aims to reintroduce free plays and bonus games on e-pull tabs, increasing tax revenues for charities.

The Democratic bill, called HF 2000, also proposes legalizing sports betting. Unlike the Republican Bill, this bill gives 11 Minnesota Native American tribes exclusive rights to provide sports betting. However, racetracks and other horse racing facilities feel that this is unfair because it would take away from their revenue.

With efforts to compromise, the Democratic bill has gone through numerous amendments to enforce gambling safety measures, including the prohibition of in-game betting and an increase to the sports betting tax rate from 10% to 20% according to Star Tribune. Each compromise has faced resistance from one or more groups, including local tribes, charities or racetracks.

As of now, the Republican bill is in the Senate, and the Democratic bill is in the House of Representatives. Whether the Republican or Democratic bill will pass first is up in the air. However, legalizing sports betting is ultimately something that both parties want because it will allow Minnesota to enter the $100 billion sports betting industry according to Miller, quoted in a legislative session.

If legalized, it will also allow Minnesotans to participate in sports betting legally. Currently, many Minnesotans illegally sportsbet in the state or travel to Iowa where it is legal according to MPR News. Legalizing it would allow the government to collect tax revenue for youth organizations, charities and educational purposes. “If we know people are going to do it, you might as well get some revenue from it, which is probably what’s going to happen,” said Carolynne Ladd, psychology teacher. “People will do it, or they’re going to do it in another state, or they’ll go to Las Vegas.”

While it will be too early to tell what consequences the legalization of sports betting will bring, it could potentially increase the risk of huge financial losses for Minnesota gamblers.

However, it can also yield great economic benefits by bringing in more revenue and job opportunities, as seen in states that have already legalized sports betting. According to the Census Bureau, New York collected $188.53 million in tax revenue from sports betting in the third quarter of 2023.

Some people also have concerns about rising gambling addiction. Although increasing addiction rates in states that have legalized sports betting have not been measured, many states have seen an increase in the number of calls for gambling hotlines. In Connecticut, for example, the Council on Problem Gambling saw a 91% increase in calls in 2022, the first year sports betting was legal. Minnesota may see similar trends, especially around big sports events like the Super Bowl or March Madness, but for now, lawmakers will continue to debate the status of legal sports betting.

![[OPINION] Tradwife trends exclude women of color](https://www.mvviewer.org/wp-content/uploads/2024/04/Untitled184-1200x873.jpg)

![[OPINION] If you want him to, just ask](https://www.mvviewer.org/wp-content/uploads/2022/10/vieweredit-32-1200x850.jpg)

![[OPINION] Public speaking should be mandatory](https://www.mvviewer.org/wp-content/uploads/2024/04/Untitled177-1200x900.png)

![[DEBATE] Should advanced classes be eliminated?](https://www.mvviewer.org/wp-content/uploads/2024/01/Untitled161-2-1200x796.png)

![[DEBATE] What’s better? Coed vs single-gender schools](https://www.mvviewer.org/wp-content/uploads/2023/12/Untitled153_20231215153759-1-1200x405.png)

![[DEBATE] Should legacy admissions still exist?](https://www.mvviewer.org/wp-content/uploads/2023/12/IMG_1460-1200x1200.jpg)

![[DEBATE] Should there be an age limit to run for office?](https://www.mvviewer.org/wp-content/uploads/2023/12/Page-8-Debates-Issue-2.pdf-820x1200.png)

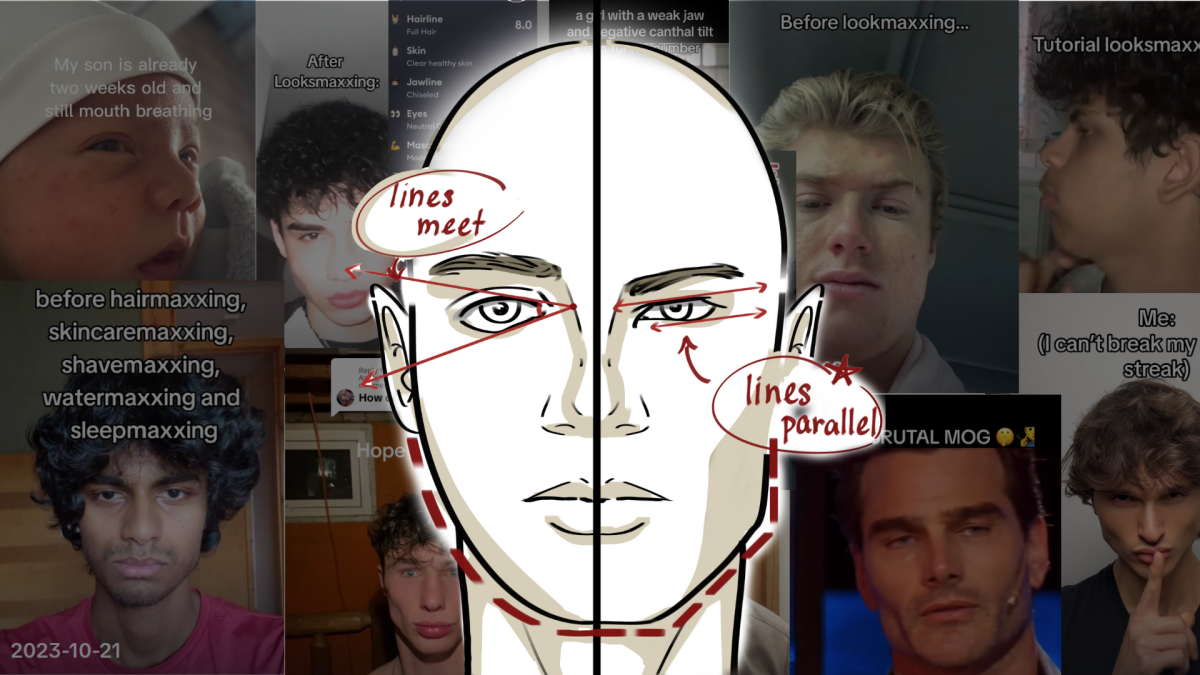

![[OPINION] The dark origins of TikToks looksmaxxing trend](https://www.mvviewer.org/wp-content/uploads/2024/02/Copy-of-Copy-of-Untitled-Design-1200x675.png)

![[DEBATE] What’s better? Coed vs single-gender schools](https://www.mvviewer.org/wp-content/uploads/2023/12/Untitled153_20231215153759-1-600x202.png)

![[DEBATE] Should advanced classes be eliminated?](https://www.mvviewer.org/wp-content/uploads/2024/01/Untitled161-2-600x398.png)